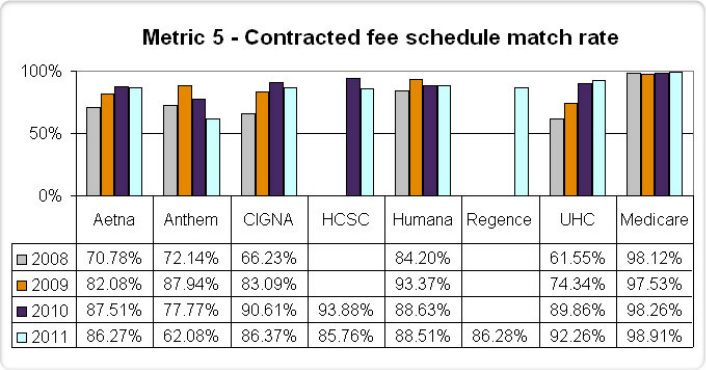

Wow. I don't know what else to say about these statistics. These come from the AMA 2011 National Health Insurer Report Card. Check out Anthem, who has an error rate of 1/3. That is amazing. Is it any wonder that there is such a high distrust from providers of their insurance companies. Is there a valid reason why all the rates across the industry should not be closer to the Medicare rate of 99%?

According to the report from 2010, should claim processing become 100% accurate, the health care system could save about $15.5 billion a year, largely by making health care more efficient and reducing administrative costs. Even just a one percent improvement could save at least $777.6 million annually in wasted administrative effort.

What is beautiful about Bern's services is that we can leverage software to reconcile the contracted rates to payments received. We can deliver a report within 2 weeks of all the underpayments from an insurance provider. You can then review and resolve these issues in a batch. We've posted the entire AMA report here.

According to the report from 2010, should claim processing become 100% accurate, the health care system could save about $15.5 billion a year, largely by making health care more efficient and reducing administrative costs. Even just a one percent improvement could save at least $777.6 million annually in wasted administrative effort.

What is beautiful about Bern's services is that we can leverage software to reconcile the contracted rates to payments received. We can deliver a report within 2 weeks of all the underpayments from an insurance provider. You can then review and resolve these issues in a batch. We've posted the entire AMA report here.